Over the next eighteen months, the pension fund is to sell all its shares in fossil fuels. Thus stated ABP today. Protest groups have been trying to influence the government and educations sector’s retirement fund’s course for years, and even the universities got involved.

The shares in fossil fuels make up some 3 per cent of the fund’s total equity portfolio and represent a value of 15 billion euros. According to ABP, the sale will not impact the pensions. Climate scientists and protesters have been warning about global warming as a result of the use of fossil fuels for years. Still, the final push for this change in course was provided by the most recent climate reports.

Dialogue

Previously, the retirement fund wanted to maintain a dialogue with the oil and gas companies in an effort to sway them towards a greener course, but this strategy has now been abandoned. ‘We have insufficient cause to believe that our influence as a shareholder will suffice to move these businesses towards sustainable energy sources’, the fund states. ‘This also enables us to meet the demands made by various groups of stakeholders and employers to withdraw from the fossil industry.’

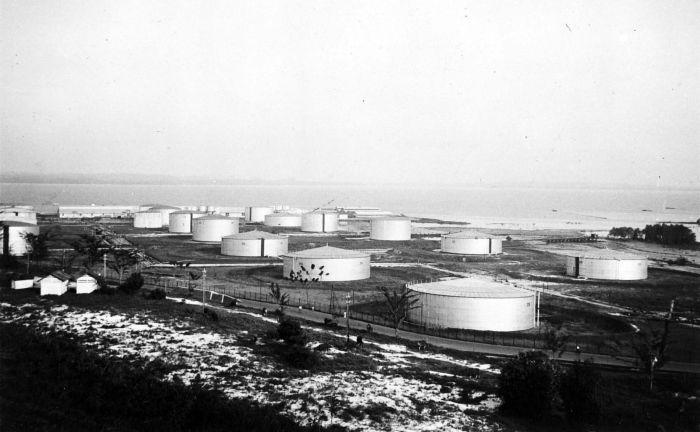

The retirement fund will continue to invest in large-scale users of fossil-based energy and aims to stimulate these parties to speed up their transition from fossil fuels to sustainable energy sources, the FAQs state. ‘This affects the automobile, aviation and electricity companies primarily. Moreover, the ABP owns shares in ‘fossil fuel production installation and storage businesses’, according to an interview with CEO Corien Wortmann. ‘This too is something we wish to abandon, but this will take more time.’

WUR

The APB has yet to reach a decision on its investments in businesses that are involved in deforestation or diversity loss. WUR’s protest group ‘Grey Hair, Green Forests’ protested against ABP’s investments in livestock and mining businesses in the Amazon and has been in dialogue with ABP on how to prevent deforestation, CO2 emissions and the loss of the ABP’s Sustainable & Responsible Investment Policy. This is to be completed by mid-2022.

Photo from the Tropenmuseum collection/Wikimedia Commons

Photo from the Tropenmuseum collection/Wikimedia Commons