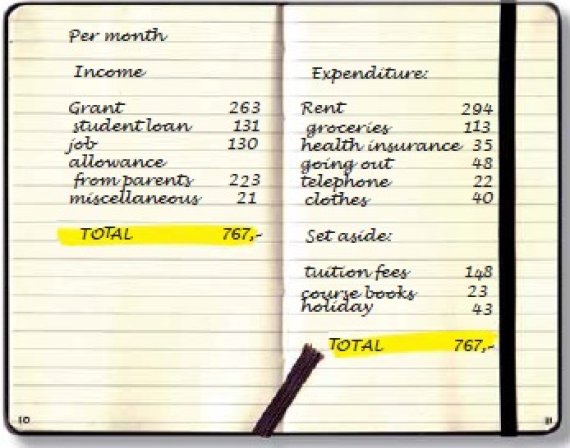

Student life is no gravy train, suggest the results of the survey we conducted among 178 established Dutch students. The average student living away from home has 767 euros to spend per month, which is comparable to social security payments in the Netherlands. Of that money, however, they need to spend about 180 euros on their studies, in the form of tuition fees and course books. Of the remaining 600 euros, half goes to pay the rent. About 113 euros is spent on groceries, less than 4 euros per day. This suggests that many students eat together and get fattened up by their parents at weekends. They spend almost 50 euros a month on going out and clothes, and the smartphone consumes more than 20 euros. And then the tight budget is spent.

I would do the same for my children

RUUD PETERS JR. MSc student of biology

‘My parents fund my higher education and that of my sister. But we are not the only ones. My neighbours get a contribution from their parents too. Perhaps that’s why I’ve never really thought about it. I do appreciate it very much because it’s quite an investment. I would do the same for my children: it is great to be able to start out on my career without a debt. I think it’s good that it is possible to get a loan at a fair rate. If I didn’t get anything from my parents I would make use of that facility. Because I would definitely study, debt or not.’

Generous parents

Where does the students’ money come from? Some of it comes from the student funding body DUO, of course, in the form of a grant. You can also obtain a supplementary loan from DUO, but remarkably few students take advantage of that: only 37 percent. On average, students living out borrow 125 euros a month. This amount can stay so low thanks to their generous parents, who invest as much as 222 euros a month in their offspring. They do this partly by paying the tuition fees and for books, but also often in the form of a fi xed monthly allowance. This means the parents provide considerably more income than the earnings from part-time jobs, which do not come to more than 122 euros a month. A Wageningen student works for barely four hours a week for an hourly wage of 10 euros. The most popular employers are catering outlets and supermarkets. But some students have jobs that are related to their studies, in the green sector for instance, or in dietary advisory services.

Princess syndrome

One remarkable outcome of the survey is that women students receive considerably more money from their parents than the men. Whereas the lads get an average of 165 euros a month, the girls get 233 euros: 40 percent more. There is no obvious explanation for this, although the suspicion does arise that the parents are prone to a ‘princess syndrome’: the feeling that girls need more protection and support than boys. The difference in parental allowance is not reflected in lower spending levels among male students. Instead, they look for alternative income sources. Boys work 20 percent more (20 hours a month on average; girls work 16) and they borrow more from DUO (142 per month, girls 124). That way they can still have a good time, and this mainly takes the form of going out. Boys spend an average of 68 euros a month on going out (girls 37 euros). Girls prefer to spend their money on clothes, to the tune of 45 euros a month (boys spend 32 euros).

Maybe it’s the Dutch ethic

RUUD PETERS SR.

One argument for funding his higher education is that I don’t want him to accumulate a debt. If I make sure he can start out on his career without a debt, he gets off to a better start. And another argument is: because I can afford it. There are plenty of people who can’t and for them the loan system is an excellent solution. My parents funded my studies too. Perhaps there is a Dutch ethic somewhere in the background. My parents were certainly raised on the message: first save and then spend. And don’t buy on the never-never. In this regard I am not impressed by the government’s plans: it’s going to be that bit harder for the next generation

In the red

Wageningen students are averse to debts: that is something the survey makes crystal clear. Apart from their student loan, if they have one, they incur hardly any debts. A very small percentage are in the red with their parents, friends or at the bank, but this is usually a matter of about 20 euros. And what if the ATM shows a negative balance at the end of the month? Then most of them (57 percent) draw on their savings – which they apparently do have as well. A small proportion (15 percent) phone their parents – there we go again – but 41 percent have no idea what they would do. It simply never happens.

Clarification – This survey was held among students in the Forum, Orion and the Leeuwenborch. 241 completed forms were returned. However, the first-year students turned out to have so little idea yet about their finances that they were taken out of the data pool. That left 178 respondents.