Thanks to the return of the basic student grant, fewer people have student debts. But those debts are higher. ‘Inequality is on the rise and that’s worrying’, believes the Dutch National Students’ Association (ISO).

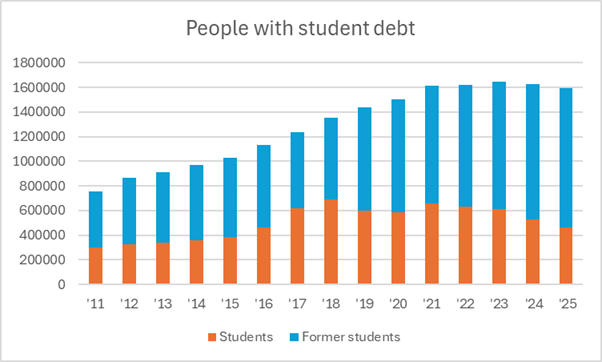

According to the latest figures from Statistics Netherlands (CBS), nearly 460 thousand students are now accumulating student debt. These are students who take out loans in addition to their basic grant and – if applicable – supplementary grant.

This number is less than in the peak year of 2021, when 657 thousand students in secondary vocational and higher education were in debt. In contrast, the number of former students in debt continues to grow: it has now reached 1.1 million.

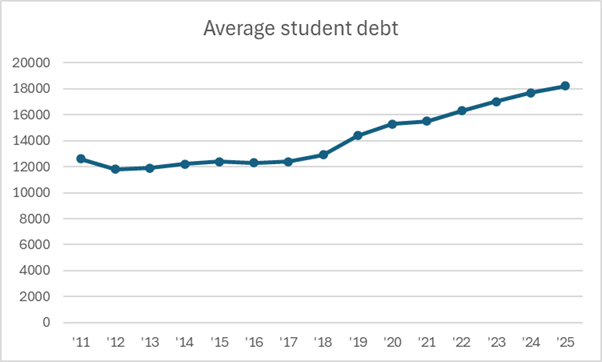

The average student debt does continue to increase, however. It now amounts to more than 18 thousand euros. The sharp increase did not occur straight away in 2015, when the new loan system was introduced, because the basic grant was discontinued only for new students. This is why it took a while for the effects to become visible.

In September 2023, the basic student grant was reintroduced. The impact of this will also grow in the years to come.

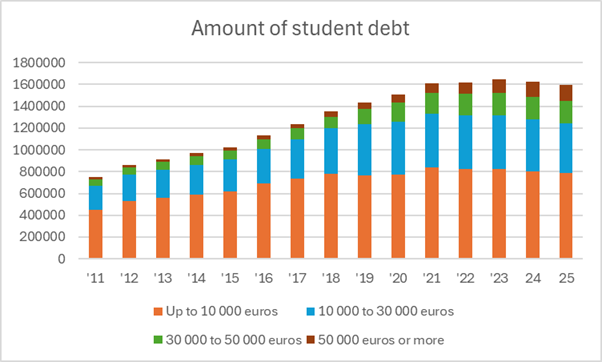

Almost half have a debt of less than ten thousand euros. A further 29 percent stay below 20 thousand euros. But there are also people with much higher student debts: 13 percent will have to pay back between 30 and 50 thousand euros, and another 9 percent owe even more.

It’s great that fewer students have to borrow money, thinks Sarah Evink, chair of the Dutch National Students’ Association. But she says the figures also show that inequality among students is increasing, which she finds worrying. ‘It’s painful to see that so many people have a student debt above 50 thousand euros.’ She fears that high debts will deter young people from continuing their studies.

Students can spread the repayment of their student debt over 35 years, plus five years in which they can pause repayment if they so desire. They have to repay based on their income, with a capped monthly amount for those with low incomes. After 35 years, the residual debt is cancelled. For years, the interest rate was zero percent, but nowadays it’s higher.

Buying a house

Given the relatively favourable terms, it’s possible that some students borrow the maximum amount and use the money when they want to buy a house. They can then take out a smaller mortgage from the bank. It’s unclear how many students actually do this.

The debate usually centres on the other side of the issue, which is that because their sizeable student debts are factored in when applying for a mortgage, many students struggle to buy a home. Politicians, meanwhile, make it easy to conceal such debts when purchasing property, despite repeated calls from various authorities not to do so.

Photo Immo Wegmann/Unsplash

Photo Immo Wegmann/Unsplash